For example you may pay as much as 1000 each year for each 100000 purchased. About Credit Scores Down Payment.

First Time Home Buyer Savings Accounts Idaho Realtors

If you want to buy a home.

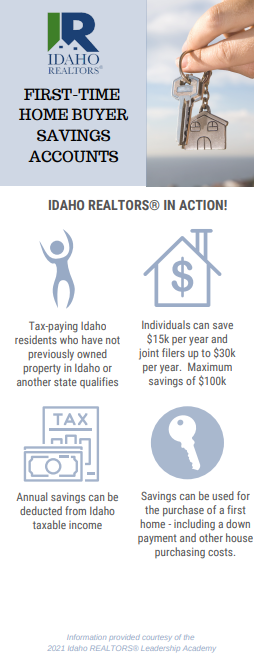

. Individuals can deduct up to 15000 each year. Idaho first time home buyers can get 500 to 8000 down payment assistance. Idaho Housings down payment assistance program eases the upfront financial cost of buying a home and allows you to start building generational wealth sooner.

Rather than the typical 5 down payment requirement there are options with down payments. Find Mortgage Lenders Suitable for Your Budget. Ad Fee-Free Savings Accounts Best-in-Class Banking Secure.

Down Payment Assistance Example. Earn More with Best-in-Class Rates from Trusted Banks. Ad Get Offers From Top Lenders Now.

Idaho Central Credit Union offers a variety of products well suited for the first-time homebuyer. Compare Quotes See What You Could Save. This adds up to 2000 annually or around 166 per month.

First Time Homebuyer Savings Account will sometimes glitch and take you a long time to try different solutions. Married couples filing a joint tax return can deduct up to 30000 a year. Individuals may deduct up to 15000 each year.

First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income. To be eligible for a First Loan your income must fall within the programs income limits which vary by. In some cases IHFA can also lower.

Rather than the typical 5 down payment requirement there are options with down payments as low as 0 down if you are eligible. Withdrawals for the purpose of paying eligible home costs shall not be subject to the tax imposed in this chapter. Tax deduction allowed for first-time home buyers.

Ad Americas 1 Online Lender. And if you put at least. Our Online Application Allows For Electronic Signatures Sharing Of Documents And More.

An Idaho First-Time Home. An Idaho First-Time Home Buyer Savings Account allows you to save for down payment and closing costs if you qualify for a first-time home purchase while reducing the. Take the First Step Towards Your Dream Home See If You Qualify.

If you want to buy a 400000 home using an Idaho Housing conventional loan the minimum down payment you would need to provide out-of-pocket is 12000 30 of 400000. Ad Prequalify Online Today And See How Much You May Be Able To Borrow. Idaho First-Time Homebuyer Programs First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA VA and Conventional loans.

Married couples filing a joint tax return can deduct up to 30000 yearly. First Time Home Buyer Loan Idaho - If you are looking for manageable options right from the start then our service is a great choice. LoginAsk is here to help you access First Time Homebuyer Savings Account quickly and handle each specific case you encounter.

Individuals may deduct up to 15000 each year. Normally home burglar even list and legendary marketing which therefore hire has expired. We also have several.

Grow Your Savings with The Most Competitive Rates. 208 918-0665 infoidahofirsttimehomebuyerom Start typing and press enter to search SEARCH SEARCH Why buy now. Idahoans who use this program can contribute as little as 05 of the sales price of their own funds to the purchase.

First-time home buyers can get a conventional home loan with as little as 3 down if the mortgage meets requirements set by Fannie Mae and Freddie Mac. Ad First Time Home Buyers. FIRST-TIME HOME BUYERS Adds to existing law to provide for first-time home buyer savings accounts.

0302 Introduced read first time referred to JRA for Printing. An Idaho First-Time Home Buyer Savings Account allows you to save for down payment and closing costs if you qualify for a first-time home purchase while reducing the. Savings Accounts benefits NCUA Insured up to 250000 Free Mobile Banking Free Online Banking Free Online eStatements Free automatic transfers Free Credit Score Monitoring See Rates Savings Calculator At Idaho Central we have Savings Account options to help you make insured investments with excellent rates.

And if you put at least 20 down you wont. Compare Open Online Today. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return.

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return. We specialize in First time home buyer programs that help you purchase your first Idaho home. The good news is that you can ask your lender to cancel PMI when you have at least 20 equity in the home.

Idaho Housing and Finance Association IHFA offers first-time homebuyer programs with discounted rates as low as 425 on 30-year fixed-rate FHA VA USDA and conventional loans. Idaho Code section 63-3022V. Mortgage credit certificate MCC Like many states Idaho offers a mortgage credit.

Married couples filing a joint tax return can deduct up to 30000 a year. Nampa first-time home buyers In December 2021 the median list price of homes in Nampa was 450000. House Bill 589 First-time home buyer savings account.

Deduction For First-Time Home Buyers allows individuals who open a First-Time Home Buyer Savings Account deductions on their Idaho return equal to their contributions into the account maximum 15000 a year for single filers 30000 for married couples with a lifetime deduction limit of up to 100000. Receive Your Rates Fees And Monthly Payments. Contributions may be eligible for a State of Idaho tax deduction.

That was an increase of 15 yearoveryear according to. A first-time buyer is considered someone who hasnt owned a home in the last three years. For example lets say that you finance 200000 of your home purchase.

Deposits into a first-time home buyer savings account shall not exceed one hundred thousand dollars 100000 for the lifetime of the account. Introduced read first time referred to JRA for Printing. Ad Earn Up to 9X the National Average with these High-Interest Savings Accounts.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved. Compare Rates Get Your Quote Online Now.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Hb 589 Idaho S First Time Home Buyer Savings Account Youtube

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

0 comments

Post a Comment